Trump Big Beautiful Bill Threatens Solar Tax Credits — But NYC Building Owners Can Still Lock Them In

Table of Contents Show

New Solar Law Just Passed — What NYC Building Owners Need to Know Now

On July 4, 2025, the Big Beautiful Bill — formally known as H.R. 1 — was signed into law. This sweeping legislation touches nearly every corner of the economy, but for NYC building owners, one piece in particular deserves your immediate attention: the future of federal solar tax credits for commercial and multifamily rooftops.

In this post, we’re narrowing in on just that. We’ll break down how the bill affects the 30% Solar Investment Tax Credit (Solar ITC), what timelines and restrictions you need to be aware of, and how building owners — whether you’re part of a Queens co-op board exploring solar, managing a rental portfolio, or overseeing a Class B commercial building — can still take smart action to lock in these valuable incentives.

At Urbanstrong, we work directly with property managers, developers, and co-op boards across New York City to help navigate solar policies like this. This blog reflects our latest insights from the field — including what’s happening behind the scenes.

If you're wondering whether now is still the right time to solarize your building’s roof, keep reading. (Spoiler: it is — but the window is closing fast.)

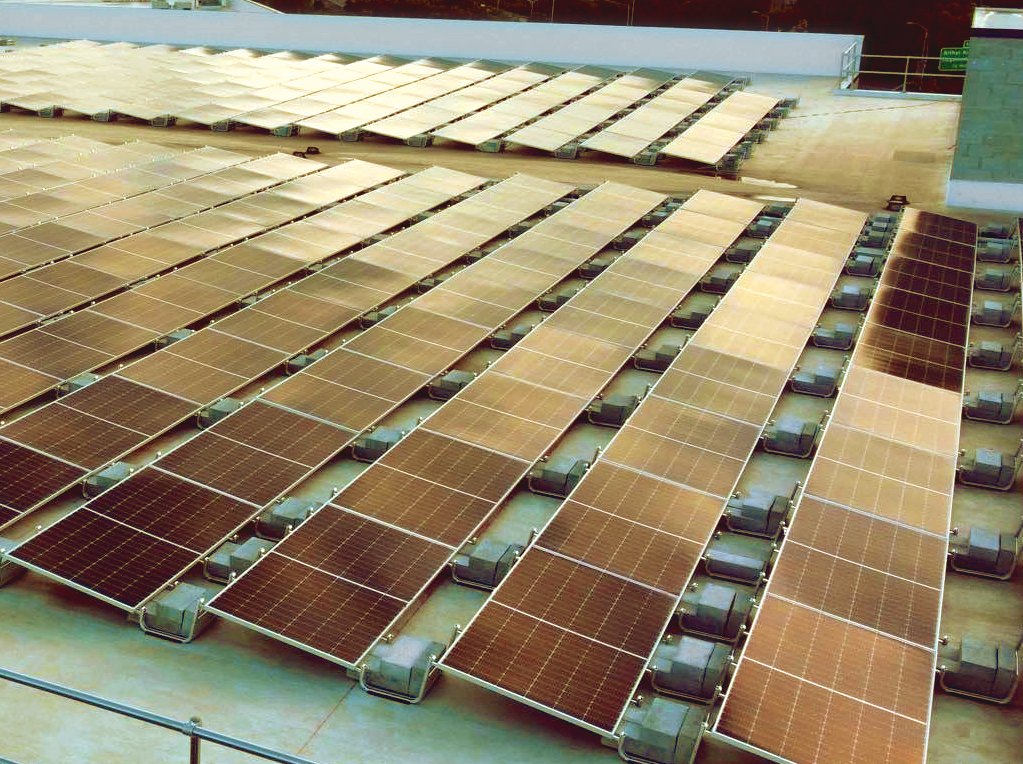

An Urbanstrong solar project atop a multifamily coop building in Inwood, NYC.

What’s Changing with the 30% Solar Tax Credit Under Trump’s Big Beautiful Bill?

Until now, building owners in New York had confidence that the 30% federal solar Investment Tax Credit (Solar ITC) would be around for years to come. The Inflation Reduction Act (IRA) gave commercial and multifamily property owners breathing room — no urgency, just opportunity.

But with the passage of the Big Beautiful Bill on July 4, 2025, that window has suddenly narrowed.

Whether you own a rental building in Brooklyn, a commercial warehouse in Queens, or sit on a co-op board exploring solar for your roof, this change matters. Here's how the new law impacts NYC solar tax credits, and what your options are to act now and still claim the full benefit.

🟦 Two Paths to Secure the 30% Solar Tax Credit

The new bill gives you two potential ways to lock in your eligibility — but both come with sharper deadlines and tighter requirements.

🔹 Path 1 to Secure the 30% Solar Tax Credit – Install by End of 2027

The most straightforward option? Get your rooftop solar system fully installed, permitted, and turned on by December 31, 2027.

This means the project must be placed in service by year-end 2027.

If you meet that deadline, your building still qualifies for the full 30% solar tax credit — no special documentation or construction start date needed.

This approach is best suited for buildings that are ready to move quickly and have a clear pathway to install within the next 18–30 months.

For many NYC building owners, this is the cleanest, lowest-risk route. But it requires taking the first step now — permitting, procurement, financing, and installation all take time.

🔹 Path 2 to Secure the 30% Solar Tax Credit – Safe Harbor by Starting Now (Caution Advised)

If your solar project won’t be completed by the end of 2027, there’s still a potential fallback: the safe harbor provision.

Under current IRS rules, you may still qualify for the 30% solar ITC if you start construction before July 4, 2026. “Start” means one of two things:

Commencing physical work (such as racking installation or roof reinforcement)

Spending at least 5% of the project cost on solar-related equipment (like panels or inverters)

Historically, many building owners have used the second approach: buying equipment early and storing it, then completing installation later — even two to three years down the line.

But now, there’s a big caveat…

🟦 Important: Trump’s July 7 Executive Order Could Change the Rules

Just days after signing the bill into law, Trump issued a July 7 Executive Order targeting what his administration views as loopholes in federal solar tax credit eligibility.

The order instructs the Treasury and IRS to tighten what qualifies as “beginning of construction.” Specifically, it warns that simply buying equipment is no longer enough — instead, projects must demonstrate “substantial progress” to be eligible for safe harbor solar ITC 2025.

This puts pressure on building owners to show real physical progress, not just a purchase order or warehouse receipt.

We expect detailed IRS guidance to be issued by mid-August 2025, but for now:

The safest path is to begin physical construction on your solar system — on-site, not on paper.

If you choose the 5% cost method, be sure to document real milestones, not just spend.

Partnering with an experienced team like Urbanstrong can help you navigate this gray zone carefully.

An Urbanstrong rooftop solar project atop a commercial storage building in Staten Island.

⚠️Why NYC Building Owners Should Wait for Treasury’s Solar Safe Harbor Guidance

President Trump’s recent executive order directs the Treasury and IRS to issue new “beginning of construction” (BOC) guidance by August 18, 2025. This guidance could significantly tighten the 5% Safe Harbor rules that lock in the 30% solar ITC and accelerated MACRS depreciation.

At Urbanstrong, we’re advising NYC co-op boards to be proactive—but not reckless. While it’s critical to plan now to secure incentives before the July 4, 2026 deadline, signing a solar proposal today comes with uncertainty.

Here’s why:

Pending guidance may change cost assumptions. Urbanstrong will pause issuing or signing proposals until this guidance is released so that all numbers can be reviewed and updated if necessary.

Other vendors may add hidden buffers. Some solar companies might pad pricing to hedge against future rule changes—potentially locking you into inflated costs.

Safe harboring early can still make sense. We recommend that NYC building owners be preparing for safe harbor compliance but waiting to finalize contracts until we have clarity.

Bottom line: Urbanstrong will revisit every outstanding proposal once Treasury’s guidance is released to ensure our clients move forward with full confidence and transparent pricing.

✅ Don’t Risk Losing the Solar Tax Credit — Talk to a Trusted NYC Partner

If your building is considering solar, the clock is ticking. These changes don’t mean opportunity is lost — but they do mean it’s time to act smartly, quickly, and with the right guidance.

👉 Urbanstrong, a trusted name in Queens, Manhattan and Brooklyn solar and commercial rooftop systems across NYC, can help you determine if your roof qualifies — and how best to lock in the tax benefits. We offer both zero-investment lease options and full ownership paths, so you can choose what works best for your building and your board.

Let us help you run the numbers, explain the new rules in plain English, and stay ahead of the policy curve.

Can I Still Use Chinese Solar Panels in 2026 and Qualify for the Solar Tax Credit?

Many NYC building owners are asking a new question we didn’t hear much last year:

“Can I still use Chinese-made solar panels and claim the 30% tax credit?”

Solar panels being produced at a factory in Hangzhou, China. Photo: Caixin Global

Under Trump voters’ latest attack on clean energy (a.k.a. the Big Beautiful Bill), new rules around foreign sourcing and content origin are set to take effect in 2026. These rules may disqualify projects that rely too heavily on solar panels or inverters from countries labeled as Foreign Entities of Concern (FEOCs) — most notably, China.

Let’s break it down.

🔹 What Are the New FEOC and Domestic Content Rules for Solar Projects?

Starting in 2026, commercial solar projects — including those on co-ops, condos, rental properties, and industrial rooftops — must pass a test called the Material Assistance Cost Ratio (MACR) to remain eligible for the solar ITC.

Projects must show that at least 40% of eligible equipment costs come from non-FEOC suppliers (i.e., not China, Russia, Iran, or North Korea).

This percentage increases over time, pushing more sourcing toward domestic or allied partners.

Projects that fail to meet this threshold may be ineligible for the solar tax credit, regardless of other compliance.

🔹 Good News: Chinese Solar Panels Might Still Be Allowed — With Limits

While the rules are tightening, there are still paths forward.

✅ MACR Compliance and the 30% Solar Tax Credit

To remain eligible for the solar ITC, commercial rooftop projects using foreign solar panels (or any Chinese-manufactured equipment) must ensure that no more than 60% of total eligible equipment costs come from FEOC suppliers. Meeting this MACR (Material Assistance Cost Ratio) test is essential for qualifying under the new bill’s restrictions.

✅ Supplier Diversity for NYC Commercial Rooftop Solar Projects

By sourcing from multiple vendors — including U.S.-assembled modules or equipment from allied countries — it’s possible to reduce reliance on Chinese panels. A thoughtful mix of products can bring commercial rooftop solar New York projects into compliance without derailing procurement timelines.

✅ Procurement Planning for NYC Solar ITC Eligibility

Projects in 2026 and beyond must be carefully structured. With proper cost documentation, vendor selection, and timeline forecasting, NYC building owners can still develop solar ITC-eligible rooftop systems, even with partial Chinese component use.

Urbanstrong can help interpret these rules for your specific building and project timeline. We’ll work with your team to develop a rooftop solar plan using an equipment mix that aligns with upcoming solar ITC rules.

What Hasn’t Changed with Solar Tax Incentives — And Why That’s Good News for NYC Building Owners

While the Big Beautiful Bill passed in July 2025 imposes stricter deadlines and sourcing rules for the solar investment tax credit (ITC), there’s good news: several valuable federal incentives remain unchanged — and they continue to support the economics of commercial rooftop solar in New York.

✅ MACRS Accelerated Depreciation Still Applies to Solar

In addition to the federal solar ITC, commercial property owners can still take advantage of the Modified Accelerated Cost Recovery System (MACRS), which allows most solar systems to be depreciated over five years.

Depending on timing and IRS rules in a given year, bonus depreciation may also apply — potentially allowing an even greater upfront deduction in year one.

For NYC property owners focused on increasing net operating income (NOI) and reducing tax exposure, MACRS remains a powerful tool. Especially when paired with the 30% solar tax credit, the financial return from solarizing a rooftop can still be strong — but only if initiated before looming deadlines.

✅ NYC Property Economics Still Strongly Favor Solar

Despite the changes brought by the Big Beautiful Bill, New York City remains one of the best places in the U.S. to install rooftop solar. Here's why the economics still make sense:

NYC electricity rates are among the highest in the country, which means every kilowatt-hour your building produces saves you more.

Most rooftops in NYC are underutilized — solar lets you turn that unused space into a productive, income-generating asset. Fewer than 0.01% of NYC rooftops are developed in any meaningful way, be that with solar panels, a green roof, rooftop farm or amenity deck. With current payback periods as low as 24 months on most Urbanstrong solar proposals, solar panels effectively print money. Building owners need to stop thinking of their roofs as lids and start thinking of them as buckets - to catch money falling out of the sky. Unless you have a burning desire to do something else with that unused roof space, it’s an absolute no brainer to fill the space with a solar array for passive income.

Green buildings command a premium in NYC’s competitive real estate market. Solar installations can improve property valuations and help attract better tenants or buyers.

🏛️ Solar Helps Buildings Comply with Local Law 97 — and Avoid Fines

NYC’s climate law — Local Law 97 — requires most buildings over 25,000 square feet to reduce their carbon emissions or face significant fines starting in 2024, with penalties escalating in 2030.

Rooftop solar is one of the most direct ways to cut emissions by reducing reliance on grid electricity, which still comes largely from fossil fuels.

This means that in addition to improving your NOI, solar can also help your building avoid thousands of dollars in annual carbon fines — while demonstrating to stakeholders that you're proactively decarbonizing.

Urbanstrong can help you evaluate your building’s emissions profile and determine how rooftop solar fits into your Local Law 97 compliance strategy.

Why NYC Building Owners Need to Act Fast — Especially Co-ops, Condos & Commercial Buildings

Between shrinking state incentives and tighter federal deadlines, NYC building owners — especially co-op boards, condo associations, and commercial property holders — must act swiftly if they want to secure the full financial benefits of rooftop solar. Here’s why:

💸 NYSERDA Incentives Are Almost Gone

The NY-Sun program, New York State’s main solar grant, is nearing its end.

Less than half of the final 30MW funding tranche remains as of this writing (for multifamily condos or coops in NYC see the Con Edison Regional Nonresidential (0-1000kW) chart here)

It’s first-come, first-served, meaning the remaining allocations could disappear in just weeks or months.

Once it’s gone, there’s no guarantee of future rounds — and any new incentives may be smaller or more restrictive.

If you want to stack federal tax credits with state-level cash incentives, between now and the end of September 2025 is likely your last, best window for a very long time. Maybe sooner, maybe later, but with everyone rushing to lock in incentives while they can, I’m guessing sooner.

🗳️ NYC Co-ops and Condos: Don’t Wait for the Perfect Moment

We’ve seen it time and again — co-op and condo boards delay solar decisions while navigating legal reviews, insurance checks, and shareholder votes.

That’s understandable. But it’s also risky.

Projects need a months-long runway to design, permit, and install solar — and if you wait too long, you may miss the December 31, 2027 tax credit deadline.

Some boards believe they have time. But they don’t factor in how long internal approvals really take.

Solar panels print money — every month you delay is a month of missed revenue from energy savings or lease payments. For many NYC buildings, this can mean thousands of dollars in unrealized income each month.

And while you're waiting, both state and federal incentives are shrinking.

When structured correctly, solar improves NOI by cutting electric bills and boosting long-term property value. But it only works if you act early enough to claim the benefits.

🏢 Commercial & Industrial: Still a Smart Way to Offset Tax Liability

For NYC’s commercial and industrial property owners, solar remains a highly effective financial tool — especially under current tax law.

The solar investment tax credit (ITC) combined with MACRS accelerated depreciation can significantly reduce tax burdens.

If you expect strong taxable income over the next 1–5 years, solar helps shelter that income while adding value to your building.

Projects can also help offset Local Law 97 penalties by lowering a building’s carbon profile.

And if you’re already planning roof work or capital upgrades, solar can often be integrated with minimal additional cost.

The economics are still solid — but you’ll need to move fast to hit the deadlines and lock in incentives.

🛑 NYC Permitting & Construction Timelines Add Pressure

New York City’s permitting, approval, and interconnection processes are among the slowest in the country. That means every delay now increases your risk of missing out.

DOB permitting and utility interconnection can take 4 to 8+ months.

Winter weather slows down or even halts construction — especially for rooftop electrical and structural work.

A project that begins mid-2026 might not be installed and approved by the December 31, 2027 ITC deadline.

If you’re serious about exploring rooftop solar for your property, 2025 is the year to act.

Urbanstrong can help you assess feasibility, model financial outcomes, and move efficiently through the design, procurement, and approval process — before the window closes.

Urbanstrong’s Two Investment Options for Solarizing Your NYC Building Rooftop

Whether you want to invest capital or avoid any upfront costs all together, Urbanstrong offers two clear options to help NYC building owners take action while incentives are still on the table.

🛠️ Option 1 – Full Investment: You Own the Solar System

This is the most financially rewarding route for buildings that have the capital or can access financing:

You own the solar system outright and capture 100% of the available incentives and revenue.

This includes the 30% solar tax credit, NY-Sun state grant, the NYC Property Tax Abatement, the MACRS accelerated depreciation, all utility savings from reduced electricity bills, and/or all revenue from the sale of the electricity into the city’s lucrative Community Solar program.

Over time, this option delivers the highest ROI and increases the building’s net operating income (NOI).

Urbanstrong handles everything — from design to permitting to installation — while you keep the upside.

This full investment, full ownership option is ideal for buildings looking to maximize long-term financial benefit, reduce operating costs, and improve asset value.

🪴 Option 2 – Zero Investment: You Lease out Your Roof, We Do the Rest

If you prefer not to invest capital or take on the operational responsibility, this model keeps things simple:

Urbanstrong’s solar investors pay for the entire system and handle all aspects of the project.

You lease your unused rooftop space and receive a contractually guaranteed lease payment for 25 years.

You collect 100% of the NYC Property Tax Abatement (20% of the total system cost)

There’s no cost, no risk, no maintenance — just predictable income from a dormant part of your property.

This No Investment, No Ownership option is especially attractive to co-op boards, condo associations, or commercial landlords with tight budgets or competing capital priorities.

Either option helps you stay ahead of the 30% ITC solar tax credit deadline and turn your roof into a productive asset.

Conclusion: The Big Beautiful Bill Just Changed Solar Incentives — But NYC Building Owners Can Still Lock In the 30% Tax Credit

The Big Beautiful Bill is a wake-up call for any NYC building still on the fence about solar. Federal and state incentives are winding down, but if you act quickly, you can still secure the full benefits.

🧠 What Building Owners Need to Remember

The 30% solar tax credit ends in 2027 — and “safe harbor” strategies are becoming stricter.

The NYSERDA NY-Sun program is nearly depleted and operates on a first-come, first-served basis.

Rooftop solar helps with Local Law 97 compliance, reduces long-term operating costs, and improves resale value.

Every month of delay is a month of missed revenue and increased risk of losing incentives.

You don’t need to decide everything today, but you do need to start the conversation.

📞 What You Should Do Next

Urbanstrong is one of the leading local solar companies in New York, with a track record of helping NYC buildings navigate this exact process.

We offer free rooftop assessments, custom financial modeling, and a clear recommendation on which investment path makes the most sense for your building.

Whether you’re in Brooklyn, Queens, Manhattan, or beyond, we help you make sense of the changing federal rules and local timelines.

Reach out today to find out how much your roof is worth — and what it will take to lock in your solar tax credits and maximize long-term value.

About The Author

Alan Burchell is the Principal of Urbanstrong, a Brooklyn-based award-winning firm specializing in sustainable rooftop solutions. A professional engineer, LEED-AP, Fitwel Ambassador and certified Green Roof Professional, Alan holds a degree in mechanical engineering, an MBA, and a Master of Science in Sustainability Management from Columbia University, with a focus on Sustainable Water Management.

For over a decade, Alan has been at the forefront of designing and implementing Solar-Integrated Green Roofs to tackle advanced rooftop stormwater management challenges. His extensive experience spans all seven continents, where he has worked as an environmentalist, project manager, speaker, and sales engineer. This global perspective enables Alan to address critical energy and water management issues, helping building owners reduce costs while complying with local codes, enhance sustainability, and boost property values.

Contact Alan today at aburchell@urbanstrong.com or 215.480.2210 or book a 15min chat directly in his calendar here.